Understanding Investment Scams: Awareness and Prevention

Investment scams work by luring people in through fraudulent schemes that promise high returns and quick wealth, only to result in financial loss. Such scams exploit trust through fake testimonials and unsolicited offers. Scammers also leverage Artificial Intelligence (AI) and social media platforms to attract unsuspecting investors.

Summarise this page with:

How Investment Scams Are Carried Out

1. Unrealistic Returns

Investment scams in Singapore often lure victims with unrealistic returns, promising high-return, low-risk opportunities that end up being significant losses. Scammers aim to target trending sectors, such as the cryptocurrency and fintech sectors. They offer returns that are too good to be true, only to vanish after funds are transferred. In this day and age, scammers are getting smarter too, exploiting Singapore's evolving fintech with tactics such as fake online platforms.

2. Pressure Tactics and High Return, Low Risks

Investment scams often rely on pressure tactics, high returns, and low risk promises to deceive victims. Scammers create a sense of urgency, often claiming that an opportunity may only be available for a limited time. They aim to push quick decisions that are made without proper due diligence. These scammers will then vanish once the funds are transferred. Such are common tactics used in Ponzi schemes and Pyramid schemes in Singapore and around the world, where early investors are encouraged to recruit others quickly.

3. Ponzi Schemes

One of the most common forms of investment scams in Singapore is the Ponzi scheme. Ponzi schemes are fraudulent investment schemes where funds from new investors are used to pay earlier ones, creating the illusion of profitability. Ponzi schemes usually rely on continuous recruitment so that the earlier investors can be paid. However, once new investments slow down, the scheme inevitably collapses, leaving most participants with significant losses. Recent Ponzi schemes in Singapore exploited trends such as cryptocurrency and fintech to lure investors. It is important to look out for investment schemes with consistent payouts despite market downturns.

4. Pyramid Schemes

Pyramid schemes are a form of investment scam where participants earn money by recruitment and not selling products. These scams usually target networked communities in Singapore and around the globe, promising high returns on investments. These fraudulent investments rely on exponential growth, making them unsustainable once recruitment slows down. It is crucial to watch out for red flags that emphasise recruitment rather than sales of products.

What to Look Out For In An Investment Scam

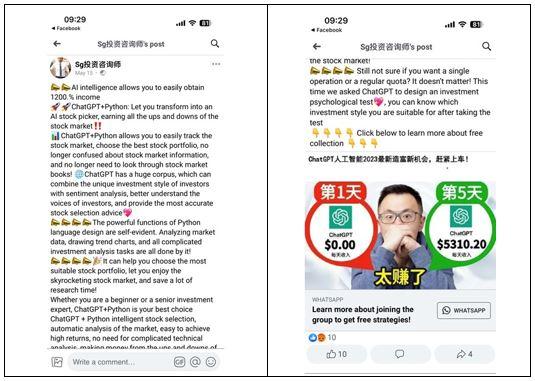

Example of investment scam Facebook advertisements in Singapore. Source: Singapore Police Force

How to Protect Yourself from Investment Scams

Verify Investment Opportunities

Before investing, verify the investment opportunity by checking the company's credentials and understanding the risks involved. Check their legitimacy with our TrustScore or with the MAS through their MAS Financial Institutions Directory, MAS Investor Alert List, and MAS Register of Representatives. Ensure that the investment is safe before doing any form of transaction with the company.

Beware of Pressure Tactics

Be aware of investment fraud in Singapore where scammers use urgency to rush decisions for investment. Scammers can use insistent phone calls or online prompts to push individuals to invest quickly without due diligence. They often exploit the fear of missing out (FOMO), especially in trending sectors such as cryptocurrency and fintech. Avoid acting under pressure. Take your time to consider investments before making a decision.

Avoid Unrealistic Returns

Avoid investments with unrealistic returns by rejecting offers which promise high returns and low risks. These schemes, often in the field of crypto, lead to losses of investments. These are key red flags for Ponzi schemes and pyramid schemes in Singapore. If the opportunity seems too good to be true, it likely is. Always conduct your due diligence to avoid falling for such fraudulent investments.

Screenshots of Fake Investment Platforms

Screenshot of fake cryptocurrency websites targetting Singaporeans. Source: Singapore Police Force

Investment Scam Examples

Investment Scam FAQs

Investment Scam in Singapore: Your Questions Answered

If you're promised guaranteed high returns or pressured to invest quickly, it's likely a scam. Always research the company first.